Overview

With the aim of supporting capacity building and talent development for banking professionals, the Hong Kong Monetary Authority (HKMA) has been working together with the banking industry to introduce an industry-wide competency framework - "Enhanced Competency Framework (ECF) for Banking Practitioners.

Since the implementation of ECF in 2018, various programmes for different job functions in banking industry have been developed and integrated into The Hong Kong Institute of Bankers (HKIB) flagship Certified Banker (CB) Programme which offer generalist, specialist, and strategic topics. The rationale for putting all programme under one professional banking qualification is to promote an industry-based common qualifications benchmark. While ECF programmes offer "role-based" knowledge and certification to Relevant Practitioners (RPs), CB is offering a vocational qualification pathway for further career advancement, being continuously enhanced to nurture more holistic banking professionals and ultimately, supporting the industry to develop a continuous learning culture and a sustainable talent pool so as to maintain the competitiveness of Hong Kong as an international financial centre.

The Enhanced Competency Framework on Credit Risk Management (hereinafter referred to as “ECF-CRM”) is a non-statutory framework which sets out the common core competences required of credit risk management practitioners in the Hong Kong banking industry. The objectives of the ECF-CRM are twofold:

(a) To develop a sustainable talent pool of credit risk management practitioners for the banking industry; AND

(b) To raise and maintain the professional competence of credit risk management practitioners in the banking industry.

Although the ECF-CRM is not a mandatory licensing regime, AIs are encouraged to adopt it for purposes including but not limited to:

(a) using the ECF-CRM as a benchmark to determine the level of competence required and assess the ongoing competence of individual employees;

(b) supporting relevant employees to attend training programmes and examinations that meet the ECF-CRM benchmark;

(c) supporting the continuing professional development of individual employees; and

(d) promoting the ECF-CRM as an industry-recognised qualification including for recruitment purposes.

Please refer to the HKMA’s “Guide to Enhanced Competency Framework on Credit Risk Management” for details.

Scope of Application

The ECF-CRM applies to RPs, i.e. persons engaged by AIs undertaking commercial credit business for corporations ranging from large corporates to small and medium-sized enterprises in a variety of industry sectors including financial institutions (e.g. banks, licensed corporations, brokerage firms, etc.). Specifically, it is aimed at RPs located in the Hong Kong office of an AI and performing the credit function in both the front office and middle office in Hong Kong, regardless of the booking location, up to the person-in-charge of credit department.

Details of the respective roles are classified by a two-level qualification structure namely Core Level and Professional Level. Please refer to the HKMA’s “Guide to Enhanced Competency Framework on Credit Risk Management” for details.

Competency Standards

The competency standards of ECF-CRM are set at two levels:

(a) Core level - applicable to entry-level and junior level staff in the credit function.

(b) Professional level - applicable to staff taking up middle or senior positions in the credit function.

Certification

RPs may apply to HKIB for certification as Associate Credit Risk Management Professional (ACRP), Certified Credit Risk Management Professional (Commercial Lending) (CCRP(CL)) or Certified Credit Risk Management Professional (Credit Portfolio Management) (CCRP(CPM)) under the following conditions:

(a) ACRP – (1) has completed the training modules M1 to M3 and passed the relevant examinations for the Core Level plus one-year relevant working experience or (2) has been grandfathered. The one-year relevant work experience should be accumulated within the three years immediately prior to the date of application for certification, but does not need to be continuous.

(b) CCRP(CL) - (1) has completed the training module M4 and passed the relevant examination for the Professional Level on top of the completion of training and passing the examination for Core Level plus five-year relevant working experience or (2) has been grandfathered. The five-year relevant work experience should be accumulated within the ten years immediately prior to the date of application for certification, but does not need to be continuous.

(c) CCRP(CPM) - 1) has completed the training module M5 and passed the relevant examination for the Professional Level on top of the completion of training and passing the examination for Core Level plus five-year relevant working experience or (2) has been grandfathered. The five-year relevant work experience should be accumulated within the ten years immediately prior to the date of application for certification, but does not need to be continuous.

ECF Affiliate:

Learners who have successfully completed a HKIB professional qualification programme (including training and examination requirements) but yet to fulfil the requirement of Relevant Practitioners or required years of relevant work experience for certification will be automatically granted as ECF Affiliate. Ordinary Membership with membership fee for the awarding year waived will also be granted to learners.

For details about ECF Affiliate, please contact HKIB at (852) 2153 7800 or email at cs@hkib.org.

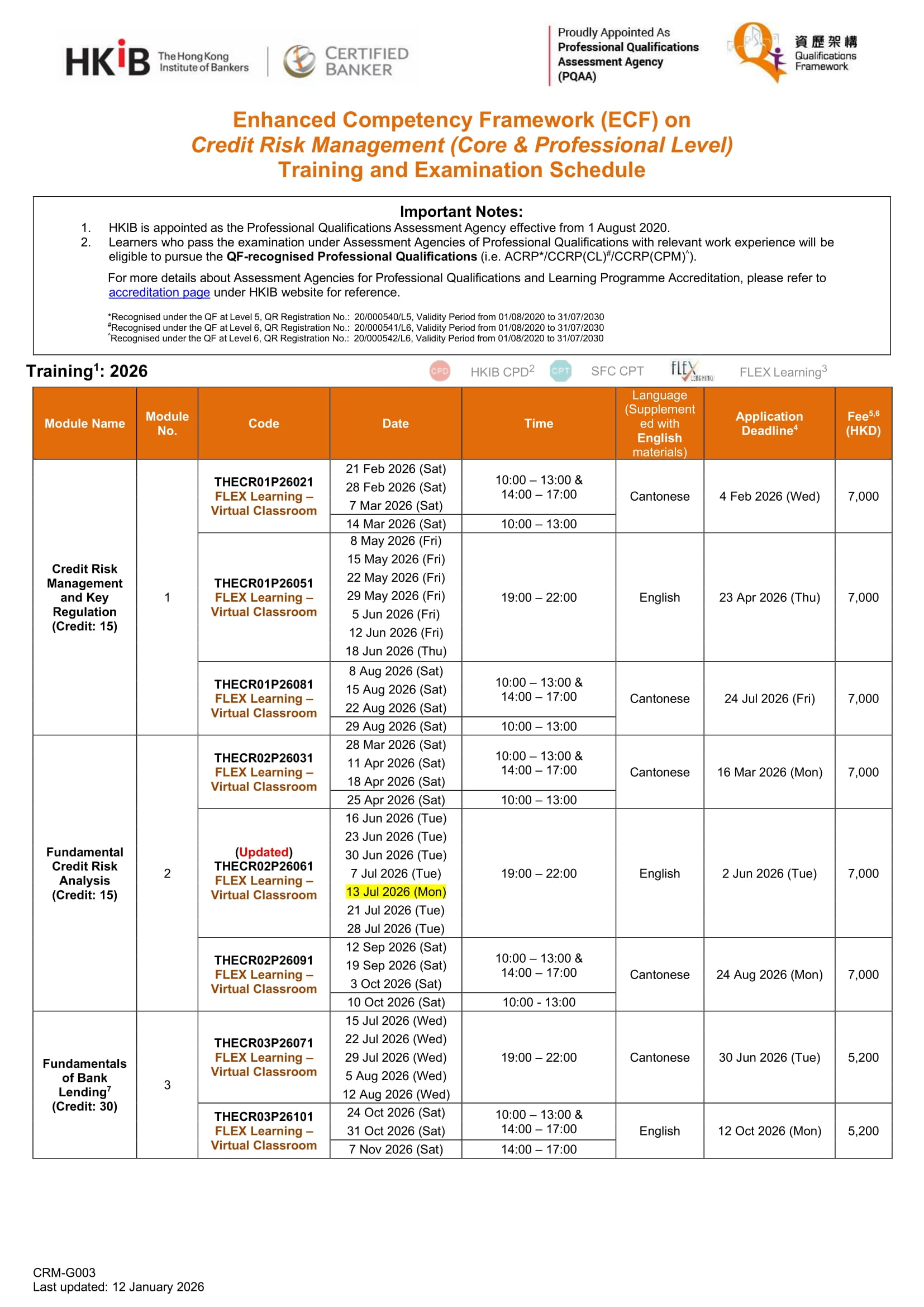

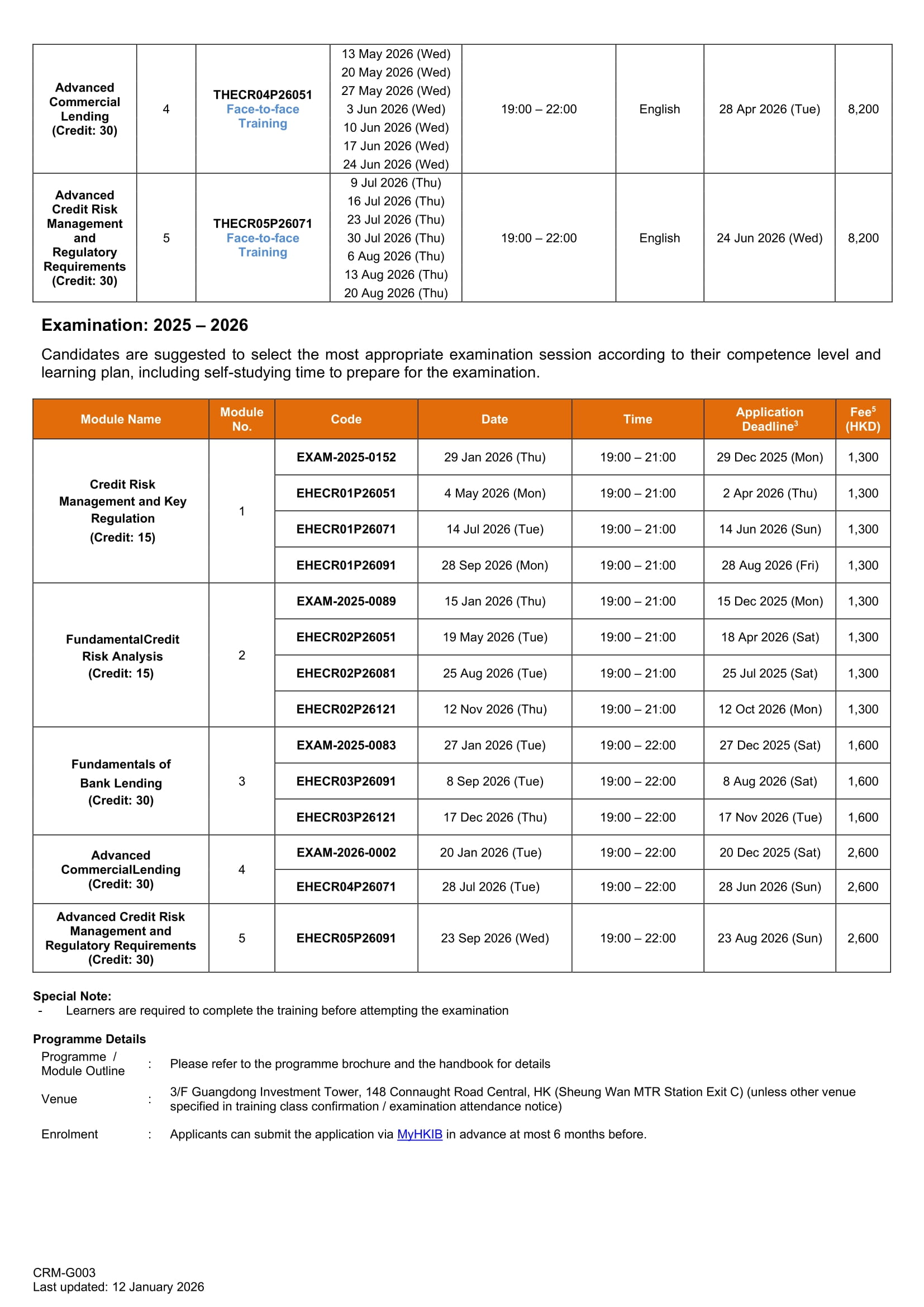

Training and Examinations

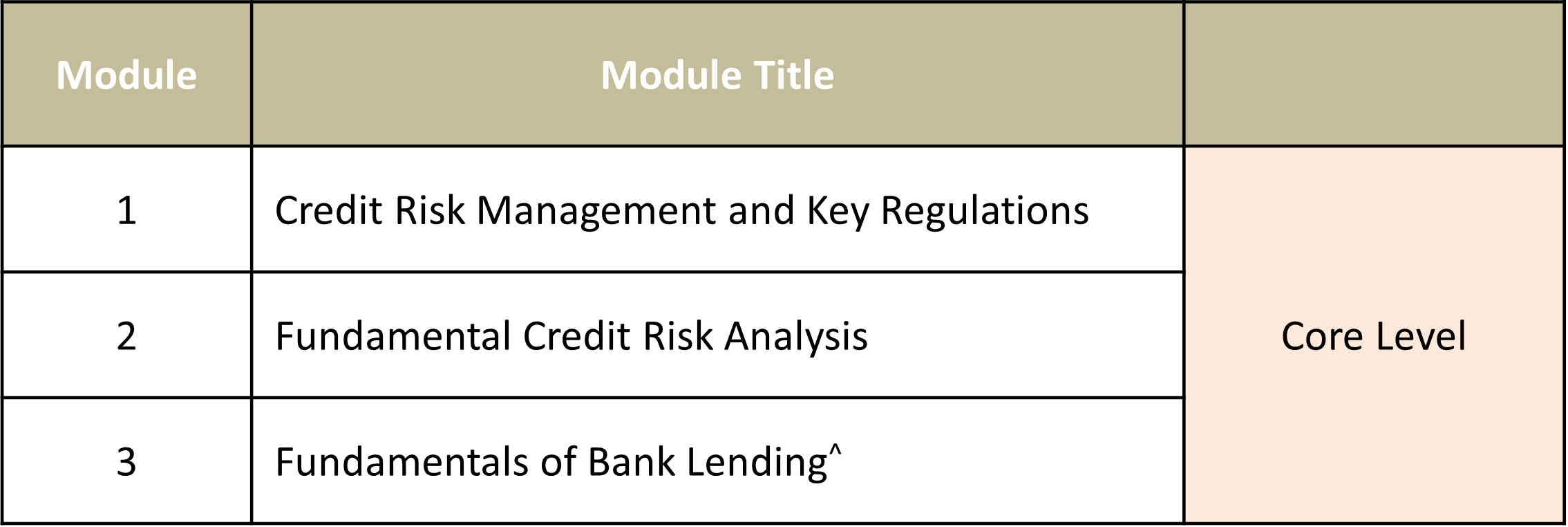

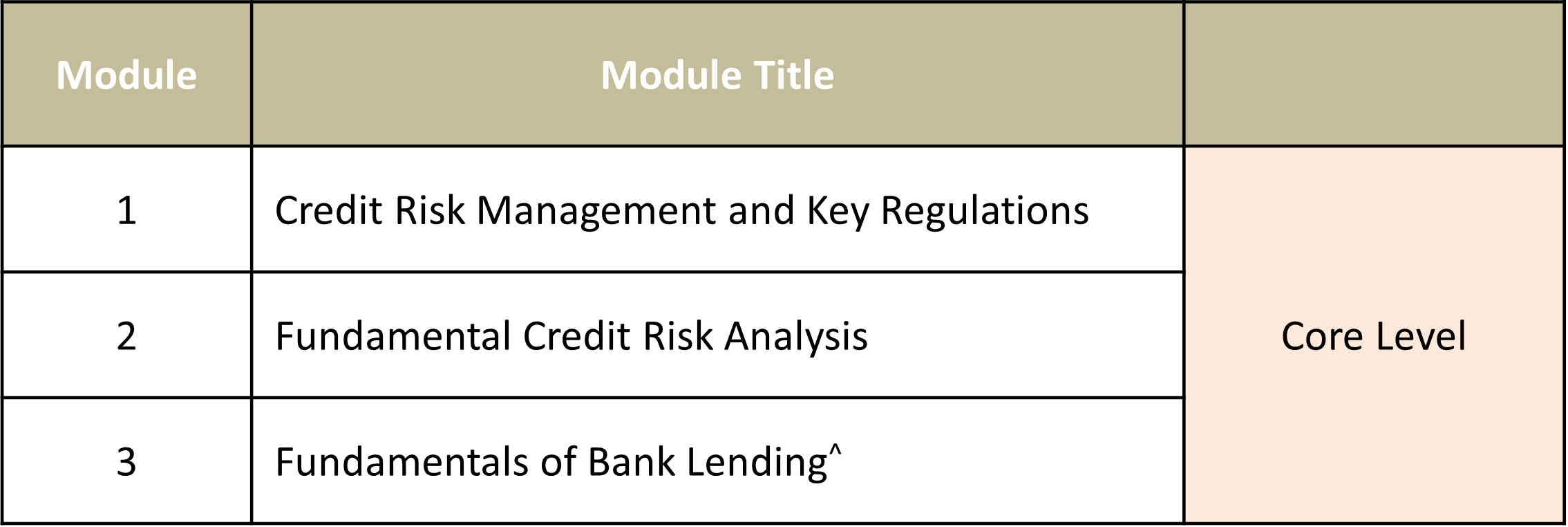

Core Level

The Core Level training programme of the ECF-CRM consists of three modules, providing the entry-level and junior level staff in the credit function with technical skills and professional knowledge and conduct in credit risk management.

Programme Structure

The programme structure is as follows:

Please refer to the Programme Handbook and Programme Brochure for more details.

^ Fundamentals of Bank Lending (Module 3) must be the last module that the learners attempt conditioned with the competition of Module 1 and Module 2 (completed Module 1 and Module 2 training and passed relevant examinations OR obtained modular exemption for Module 1 and Module 2).

Entry Requirement

The Programme is open to members and non-members of HKIB. Candidates must fulfil the stipulated minimum entry requirements:

- A Bachelor's Degree in any discipline awarded by a recognised university or equivalent; OR

- An Associate Degree (AD) / Higher Diploma (HD) in a banking and finance discipline or equivalent; OR

- A relevant professional qualification; OR

- Mature applicants with 3 years of relevant banking experience with recommendations from employer

Remark:

- 3rd or final year full-time university undergraduate students in banking and finance discipline will be considered.

- Mature applicants (aged 21 or above) who do not possess the above academic qualifications but with relevant banking experience and recommendation from their employers will be considered on individual merit.

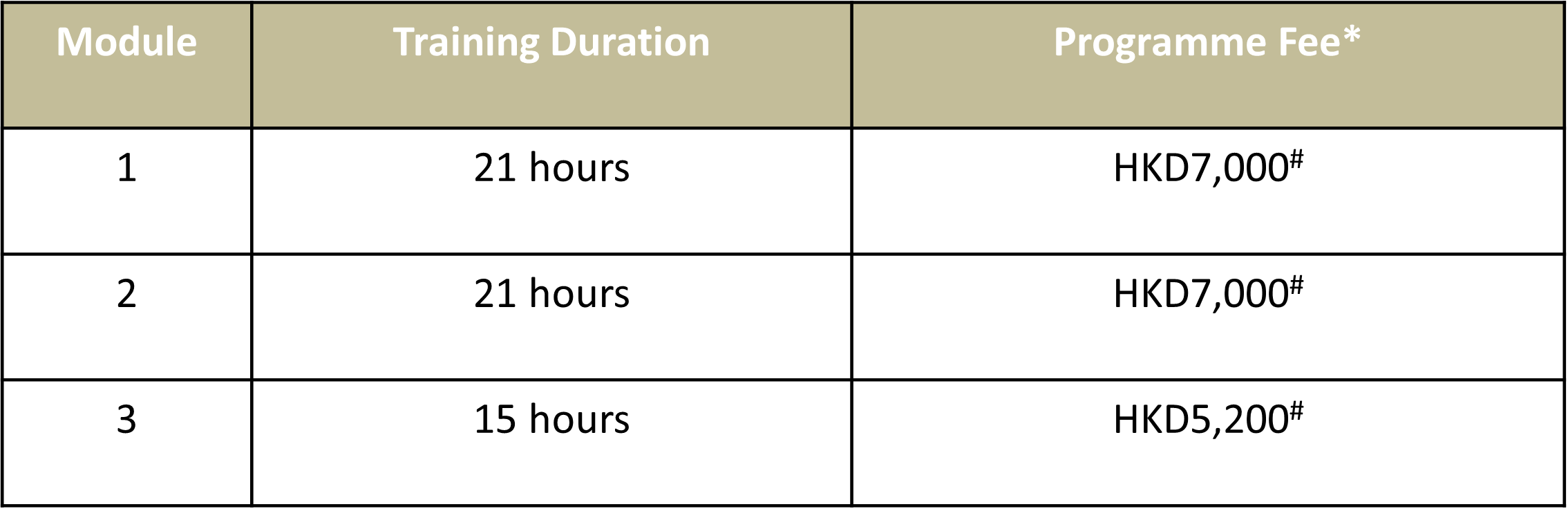

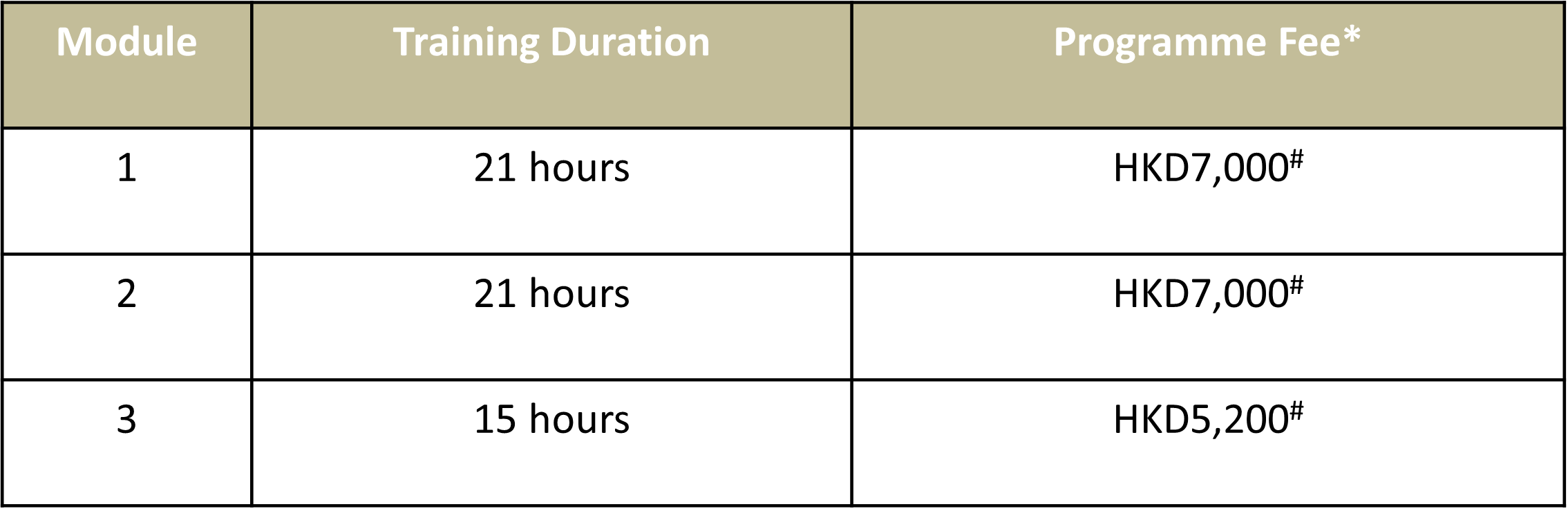

Training Duration and Fee

# A digital version of Study Guide and PPT Slides will be provided before the training commencement. Printed version will only be available at an additional cost of HKD600 (including delivery fee) on request by learners.

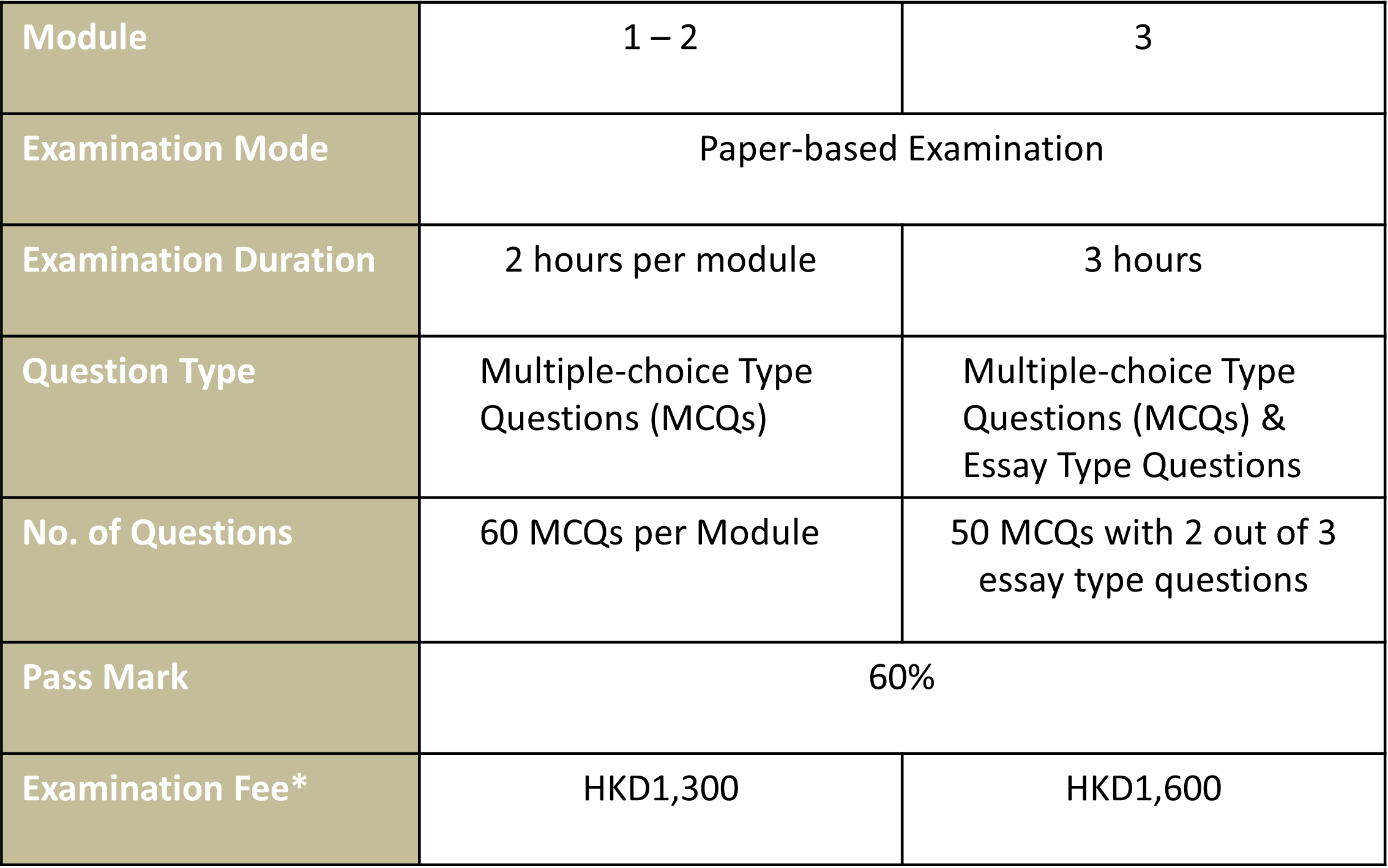

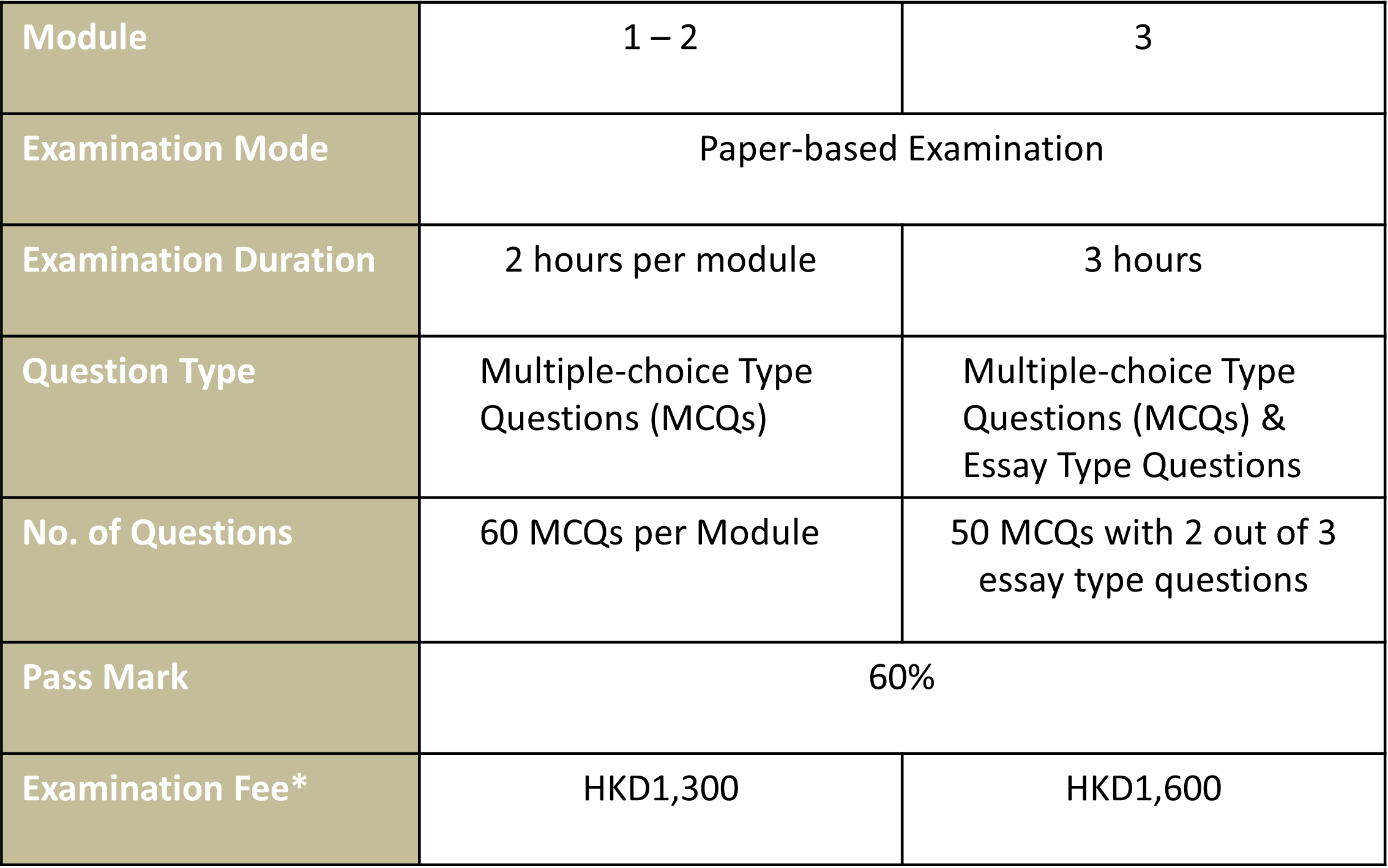

Examination Format and Fee

All examinations for Core Level are closed-book examination.

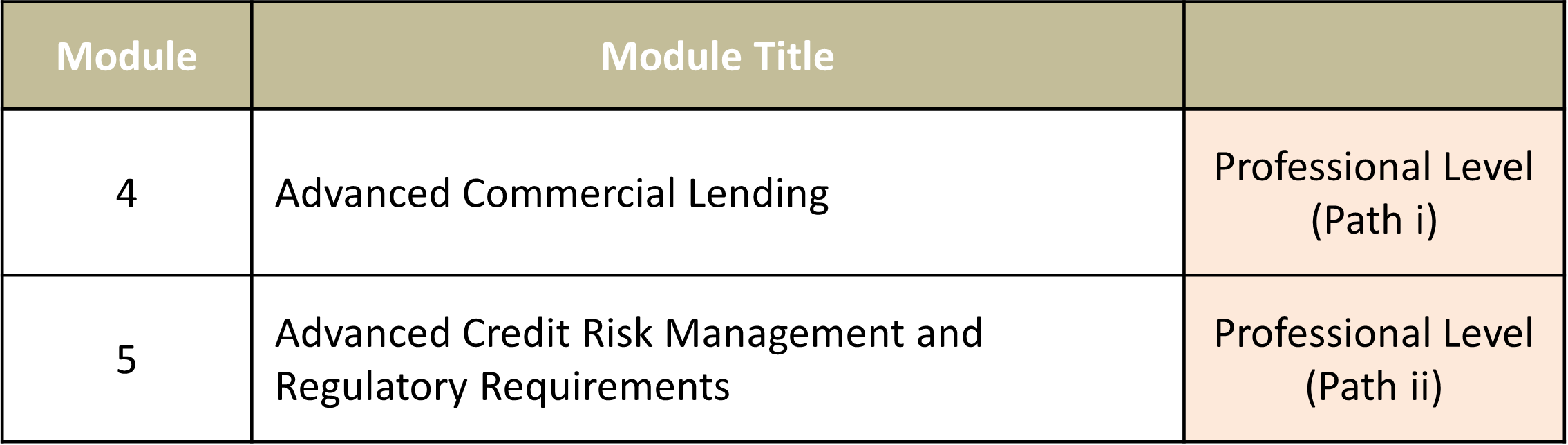

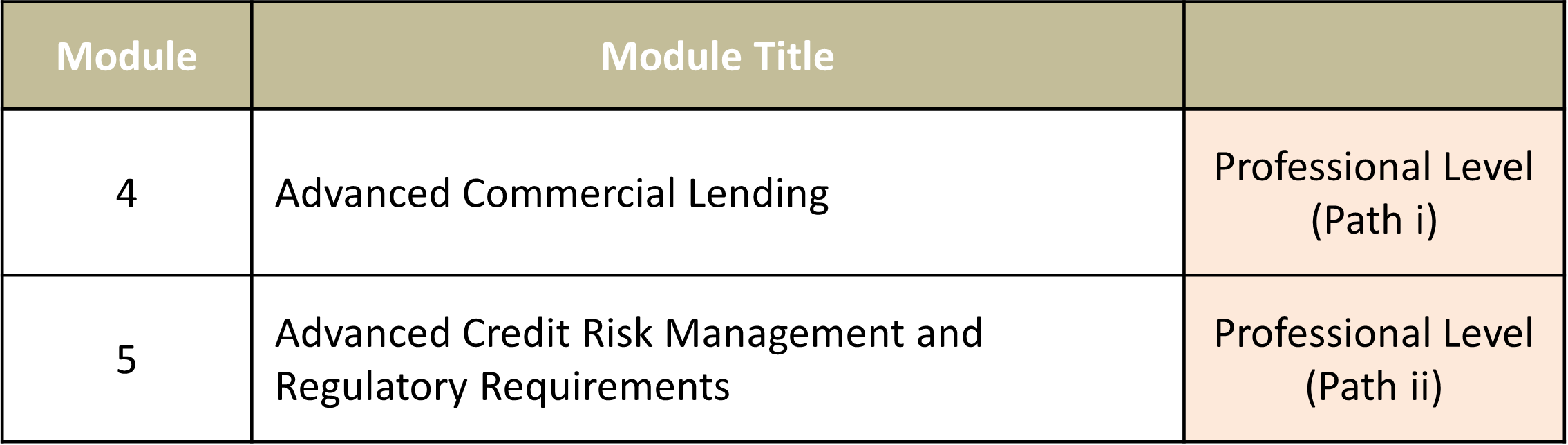

Professional Level

The Professional Level training of the ECF-CRM consists of two programmes, providing the essential middle or senior level of job roles in the credit function that take up a majority of credit risk responsibility in the credit process, including credit initiation and appraisal, credit evaluation, approval and review.

Programme Structure

The programme structure is as follows:

Please refer to the Programme Handbook and Programme Brochure for more details.

Entry Requirement for Module 4

The Programme is open to members and non-members of HKIB. Candidates must fulfil the stipulated minimum entry requirements:

- Professional Certificate for ECF on Credit Risk Management (CRM) awarded by HKIB; OR

- Grandfathered for ECF on Credit Risk Management (Core Level) by HKIB; OR

- Grandfathered on Credit Portfolio Management for ECF on Credit Risk Management (Professional Level) by HKIB.

Entry Requirement for Module 5

The Programme is open to members and non-members of HKIB. Candidates must fulfil the stipulated minimum entry requirements:

- Professional Certificate for ECF on Credit Risk Management (CRM) awarded by HKIB; OR

- Grandfathered on ECF on Credit Risk Management (Core Level) by HKIB; OR

- Grandfathered on Commercial Lending for ECF on Credit Risk Management (Professional Level) by HKIB.

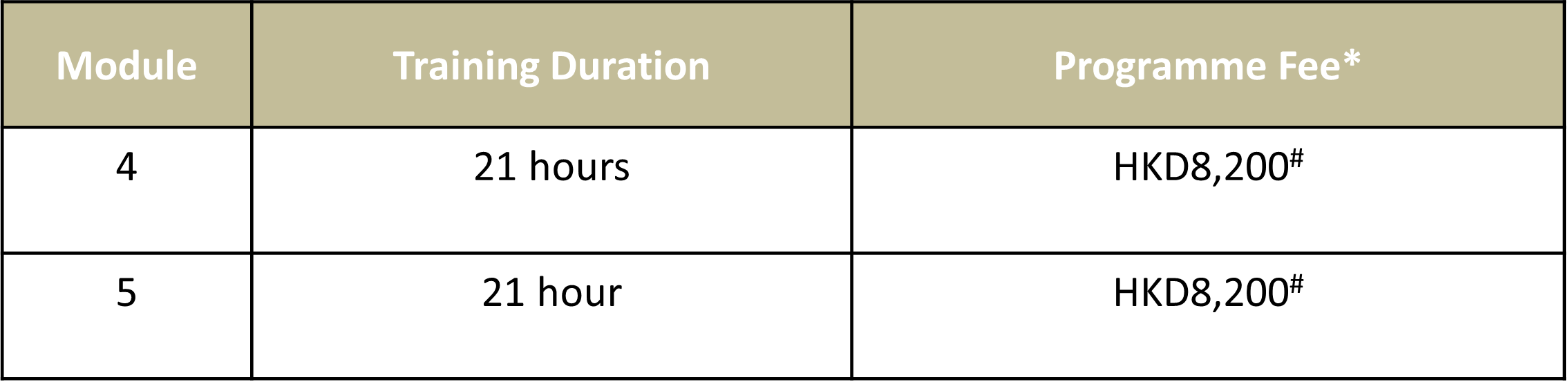

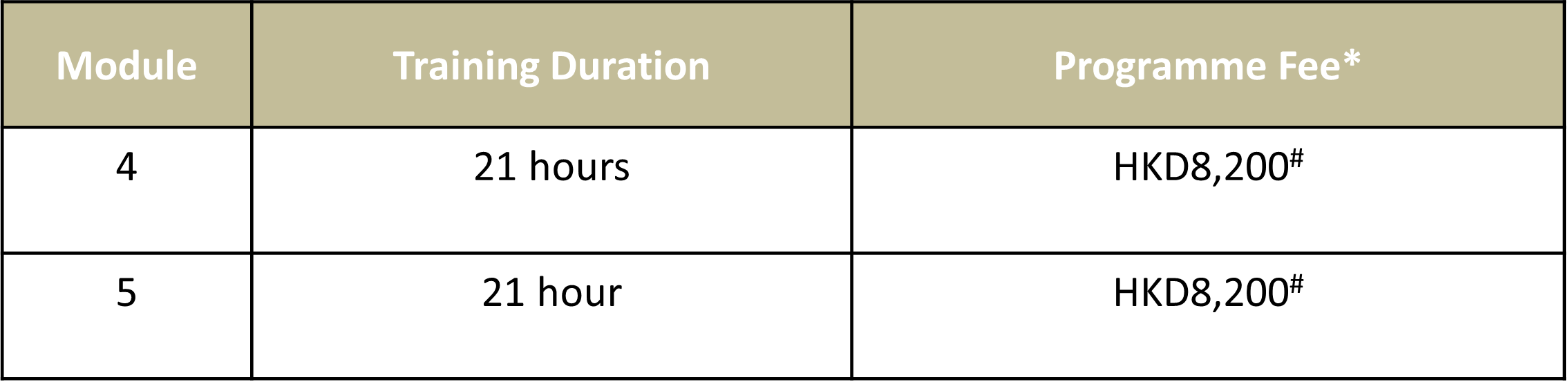

Training Duration and Fee

# A digital version of Study Guide and PPT Slides will be provided before the training commencement. Printed version will only be available at an additional cost of HKD600 (including delivery fee) on request by learners.

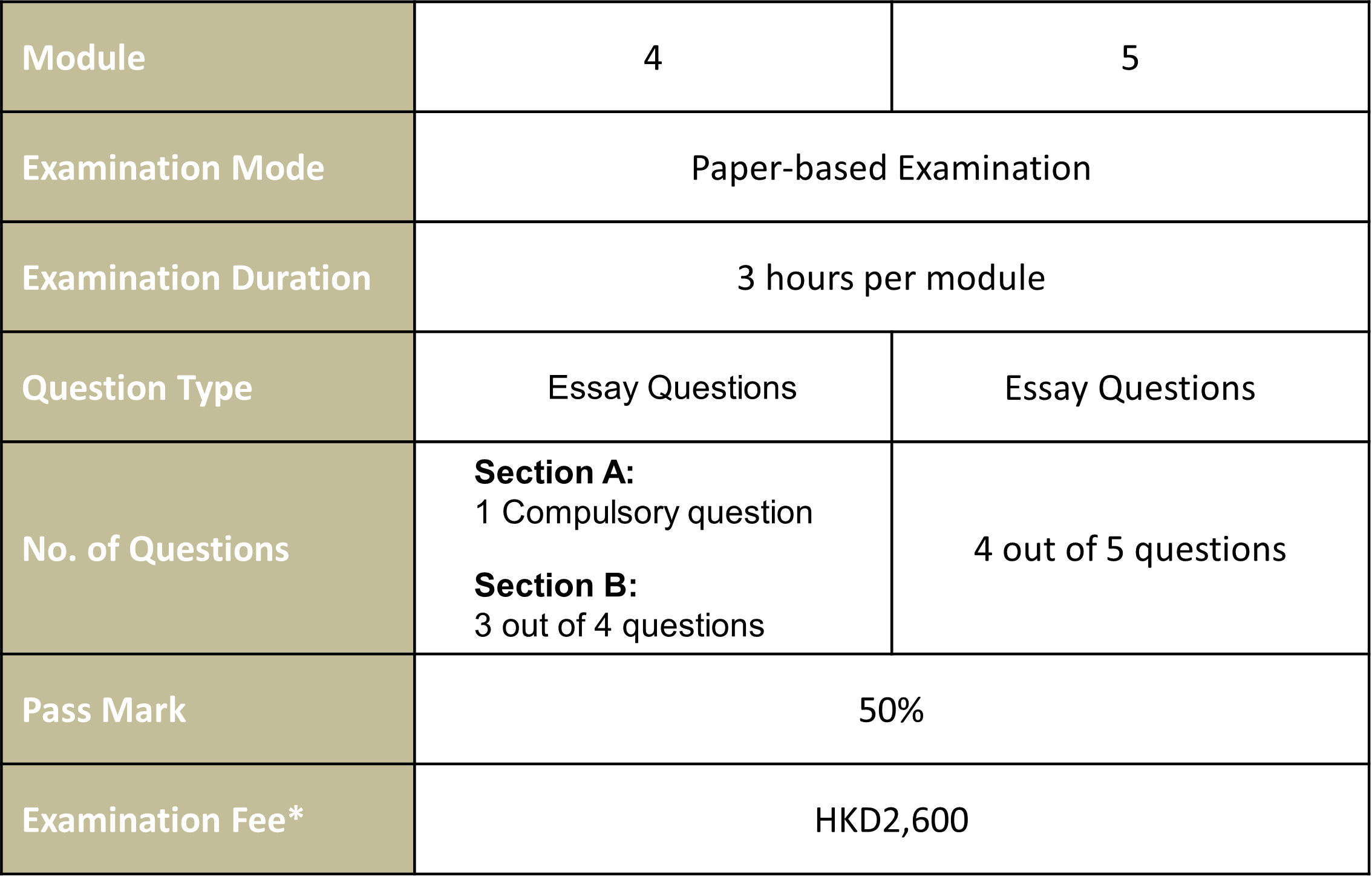

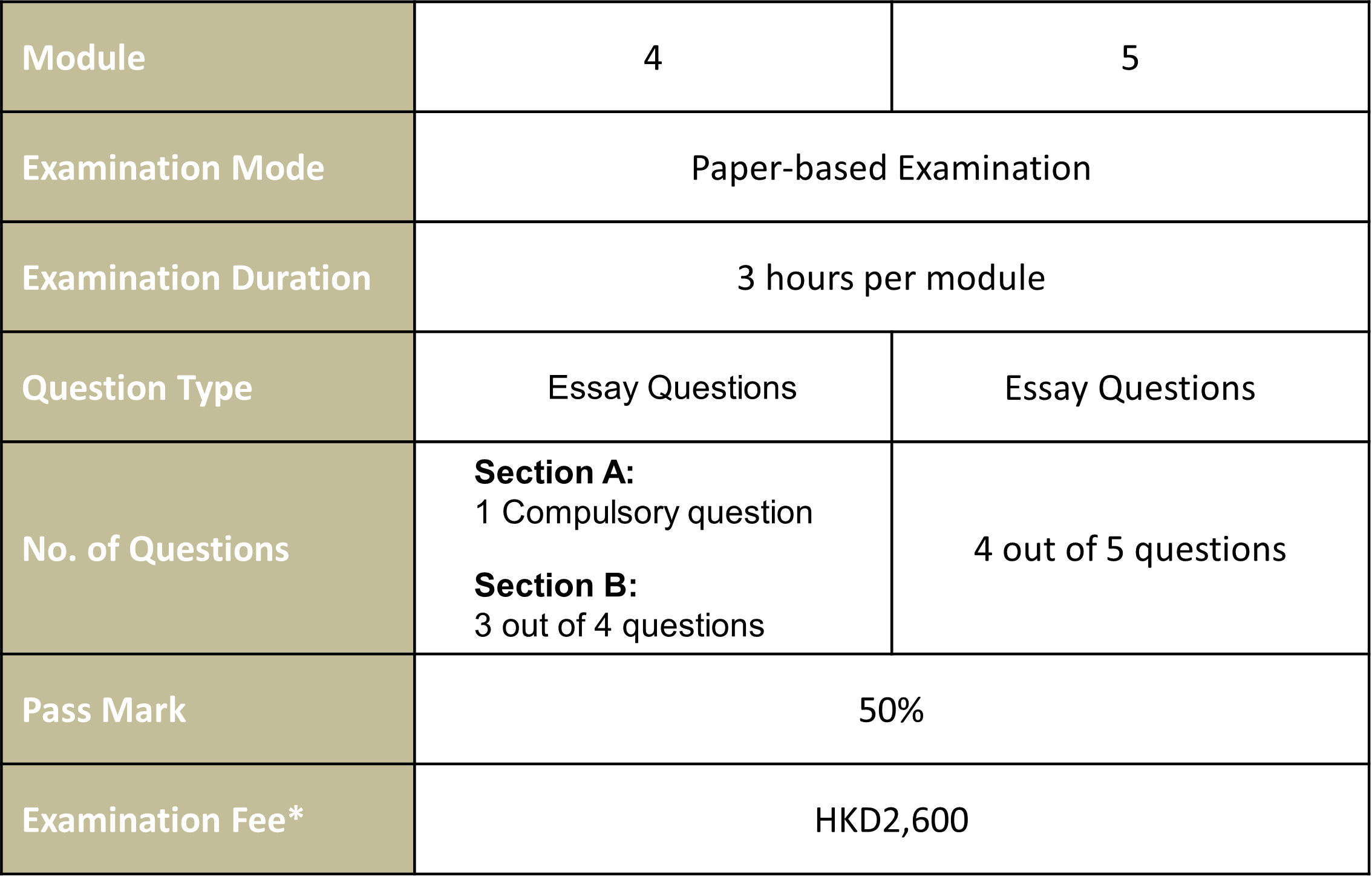

Examination Format and Fee

All examinations for Professional Level are closed-book examination.

* HKIB student members can enjoy 25% off training fee discount and 50% off examination fee discount respectively.

Training and Examination Enrolment

Applicants can submit the application via MyHKIB.

Late entries for training programmes are accepted up to seven days after the stipulated application deadlines. An additional late entry fee of HKD200 applies.

Late entries for examinations are accepted up to 14 days after the stipulated application deadlines. An additional late entry fee of HKD200 applies.

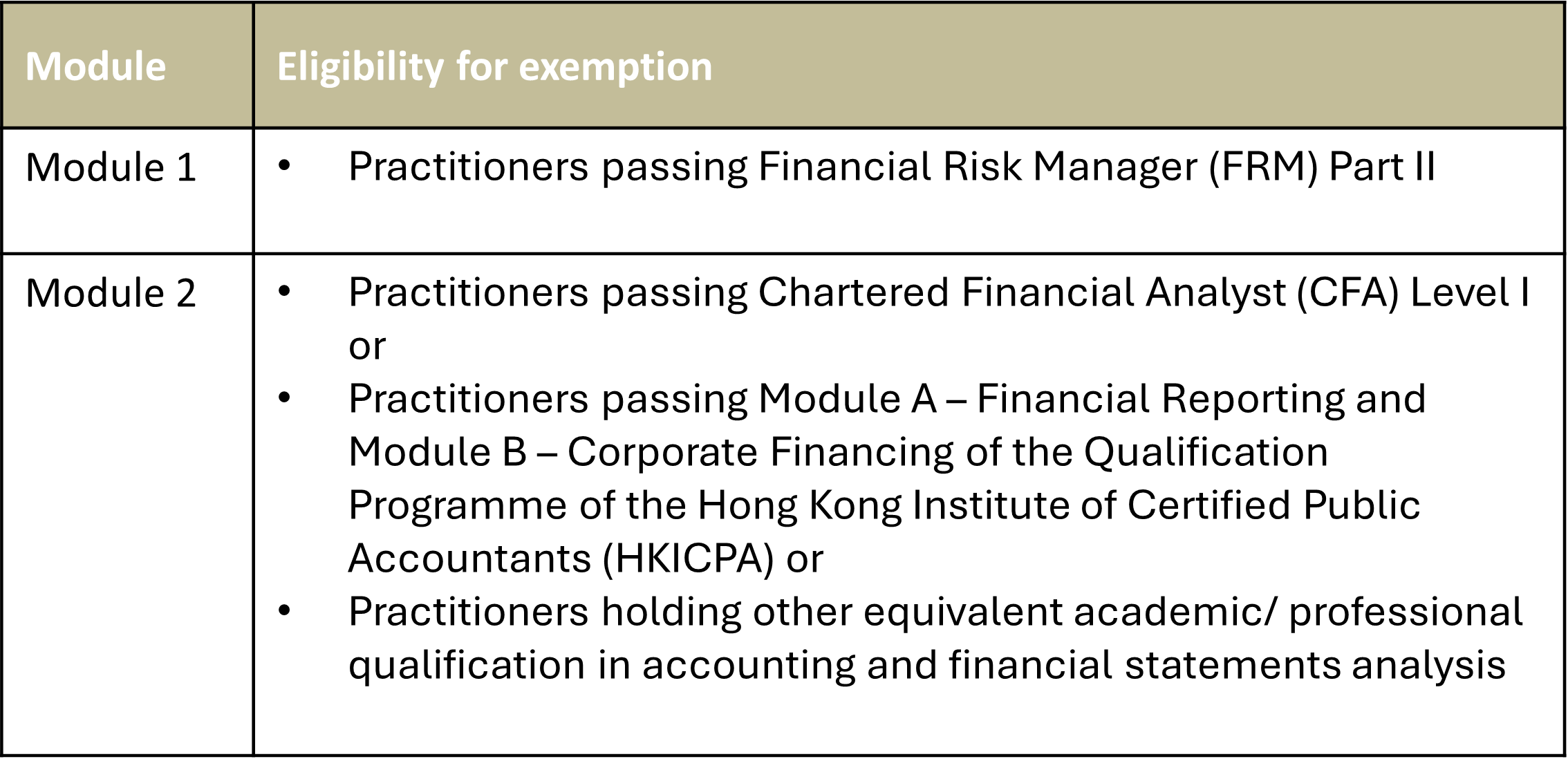

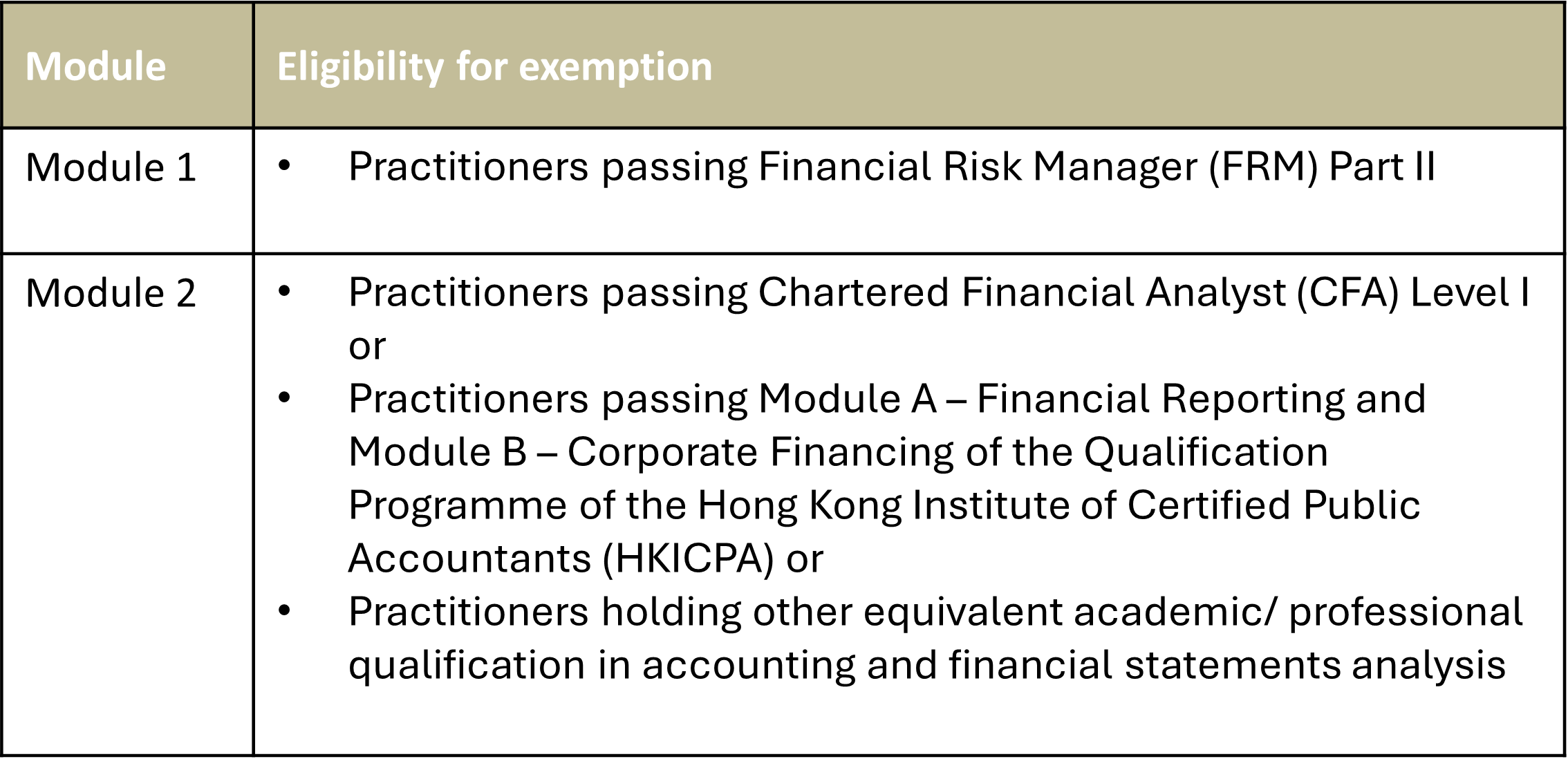

Exemption

Candidates holding the following qualifications may apply for Modules 1 or 2 exemption of "ECF on Credit Risk Management (CRM) (Core Level)".

Please refer to "Modular Exemption Application Form" for more details.

Grandfathering

A RP may be grandfathered on a one-off basis based on his or her years of qualifying work experience and/or professional qualification. Such work experience need not be continuous. The detailed grandfathering requirements are as follows:

a) Core Level:

- Possessing at least three years of relevant work experience on or before 30 September 2020 in any of the functions in credit initiation, evaluation, approval and review and/or credit risk management and control as specified in Annex 1 of the HKMA’s “Guide to Enhanced Competency Framework on Credit Risk Management”; and

- Employed by an AI at the time of application.

b) Professional Level:

Path (i):

- Possessing at least eight years of relevant work experience on or before 30 September 2020 in any of the functions in credit initiation, evaluation, approval and review and/or credit risk management and control, of which at least five years are gained from Professional Level job roles, as specified in Annex 1 of the HKMA’s “Guide to Enhanced Competency Framework on Credit Risk Management”; and

- Employed by an AI at the time of application.

OR

Path (ii):

- Completion of HKIB’s Postgraduate Diploma for Certified Banker (Credit Management Stream); and

- Possessing at least three years of relevant work experience on or before 30 September 2020 in any of the functions in credit initiation, evaluation, approval and review and/or credit risk management and control as specified in Annex 1 of the HKMA’s “Guide to Enhanced Competency Framework on Credit Risk Management”; and

- Employed by an AI at the time of application.

Relevant work experience may be obtained from the banking industry and/or other related financial sectors.

Please refer to the Guideline for ECF-CRM Grandfathering for details on grandfathering eligibility criteria and requirement.

The one-off grandfathering arrangement ended on 30 September 2020. For individuals who have sufficient relevant work experience but are not working in an AI or are not performing specific credit functions during the grandfathering period from 1 October 2019 to 30 September 2020, they may submit their applications to HKIB for grandfathering within 3 months from the date of joining the credit function of an AI and becoming a RP. However, applicants should have met all the applicable grandfathering criteria as prescribed above on or before 30 September 2020. A one-off grandfathering fee will apply.

Annual Renewal of certification and Continuing Professional Development (CPD) Requirements

Certification of ACRP, CCRP(CL) and CCRP(CPM) are subject to annual renewal by HKIB. PQ holders are required to comply with the annual CPD requirements and pay an annual certification renewal fee to renew their ECF-CRM certification.

The requirement is a minimum of 15 verifiable CPD hours for each calendar year (ending 31 December), of which at least 5 CPD hours must be earned from activities related to topics of compliance, code of conduct, professional ethics or risk management.

For ECF Affiliate, at least 3-hours of CPD within the scopes mentioned in HKIB CPD Scheme is required annually for certification renewal.

Any excess CPD hours accumulated within a particular year cannot be carried forward to the following year.

The CPD requirements will be waived for the first calendar year (ending 31 December) of certification and grandfathering.

For details, please refer to the Overview of HKIB CPD Scheme and HKIB CPD Requirements webpage under HKIB website.

Integration of ECF in Certified Banker (CB)

Certified Banker (CB) is a professional banking qualification programme developed and offered by HKIB. This common qualification benchmark is intended to raise the professional competency of banking and financial practitioners in Hong Kong to meet modern demands, while providing a transparent standard with international recognition. “ECF-CRM (Core Level and Professional Level)” have already been incorporated in CB (Stage II) and CB Specialist Stream respectively. You may refer to the CB Programme structure to plan for your learning path. Learners who have obtained a pass at the relevant examination can then apply for an exemption for the elective module “ECF-CRM (Core Level)” of the CB (Stage II) programme and the elective module “ECF-CRM (Professional Level)” of the CB Specialist Stream programme.

Scholarship

Each year, HKIB selects the top two candidates from each competency level (Core/Professional) and award them with the scholarship as recognition. This is the way for HKIB to promote academic excellence and motivate future students to push themselves to achieve same high level of performance. The two top candidates in each competency level (Core/Professional Level), provided that all other granting requirements are met, can be awarded with a cash incentive (HKD5,000 for Core Level; HKD6,000 for Professional Level), and a study coupon which can provide candidates to study one more professional qualification offered by HKIB with all training and examination fees waived.

General Enquiry / Feedback

|

Hotline

|

Email

|

|

(852) 2153 7800

|

cs@hkib.org

|