Certified Banker - Overview

|

Hong Kong Qualifications Framework

Certified banker (CB) at QF level 6

QR Registration no: 20/000543/L6

QR Registration Validity Period: 01 Aug 2020 – 31 Jul 2025

Mode of Study

Part-time

Mode of Instruction

FLEX Learning – Virtual Classroom / Face to face / Self-paced Learning

Language

Cantonese / English (Supplemented with English materials)

|

Enquiries

21537800

cb@hkib.org

|

Programme introduction

In a constantly evolving banking landscape, it is vital that new and existing practitioners keep their knowledge up to date and learn new skills for their career advancement and to support development for the industry.

Read more

The Certified Banker Programme is the flagship banking-oriented professional qualification programme of HKIB that offers a broad range of general, specialist and strategic skillsets to practitioners and is the first professional banking qualification in Hong Kong accredited at QF Level 6 – equivalent to a master’s degree. It aims to promote a common qualifications benchmark to provide practitioners with better career prospects and a clear vocational qualifications pathway.

The Certified Banker Programme is different from other bank training courses in Hong Kong. The Certified Banker Programme has a dynamic structure and integrates elements from the HKMA’s Enhanced Competency Framework (ECF), allowing practitioners to become holistic banking professionals.

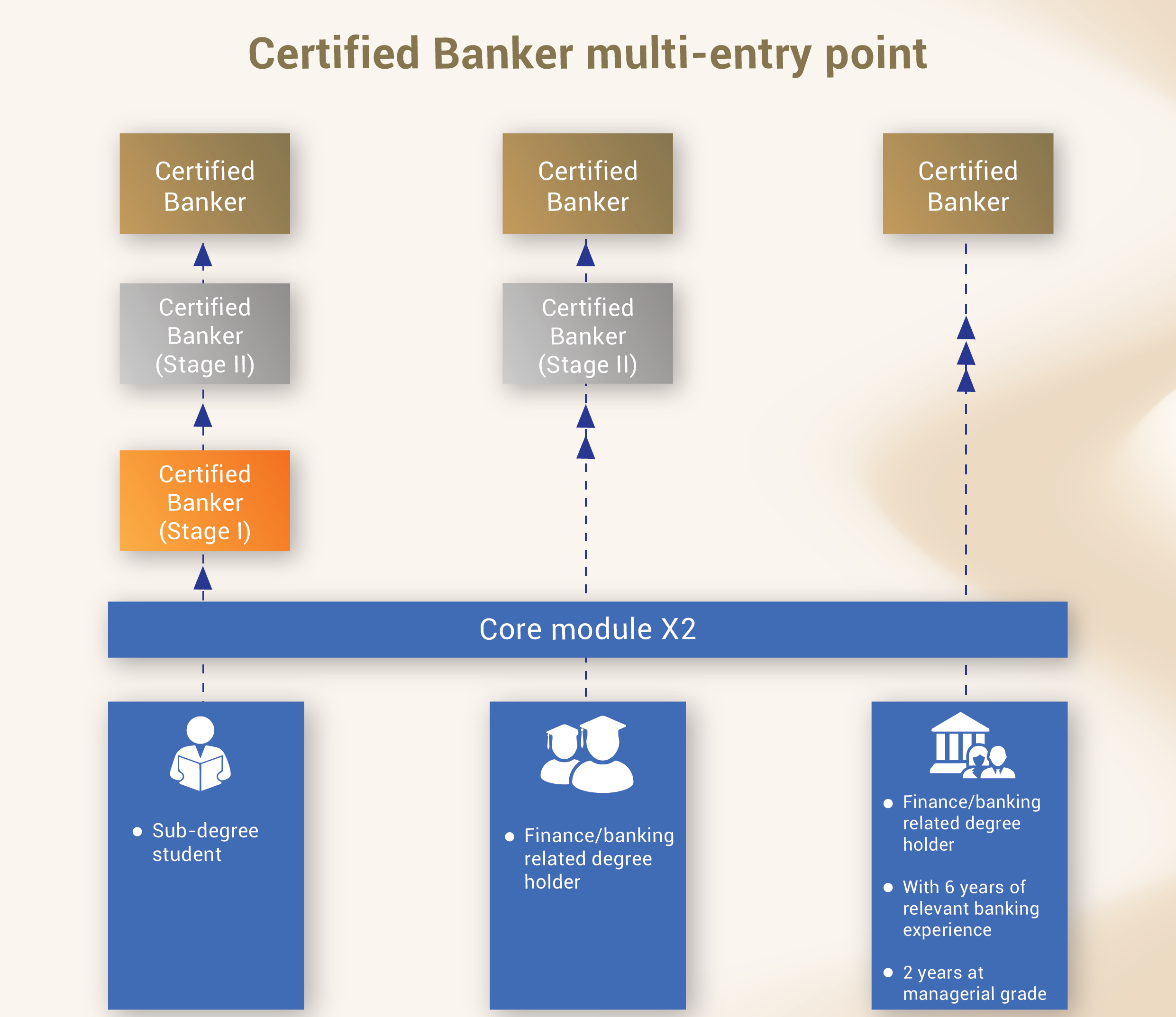

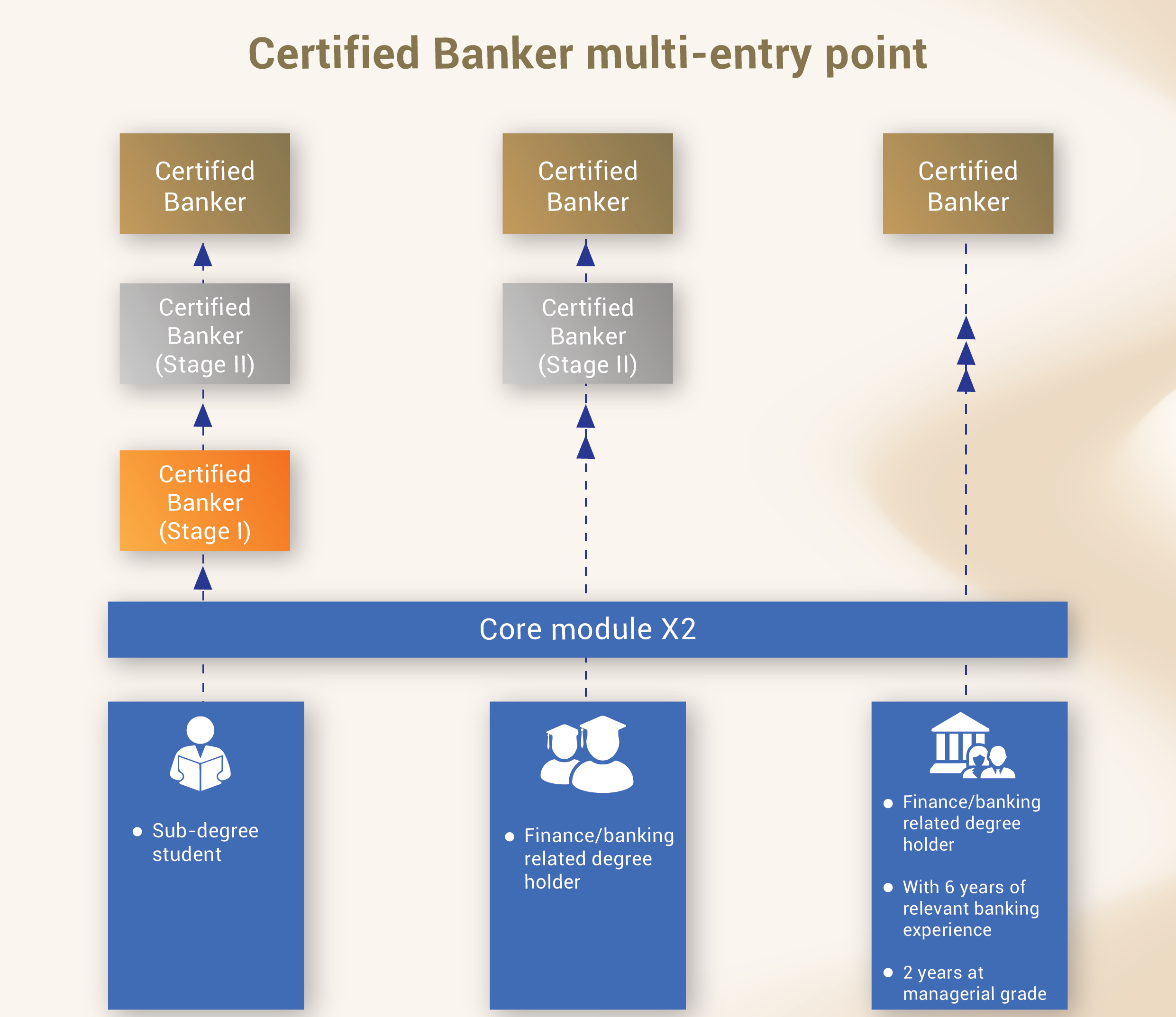

Offered by Hong Kong’s most respected banking training institute, this programme has multiple entry levels for people from diverse backgrounds, including:

- Current practitioners looking to enhance their knowledge and skillsets for their professional development and career advancement (direct entry).

- Talent from outside of banking who would like to switch their career to the banking sector (CB Stage I).

- Students who would like to gain an edge when hunting for a job in the banking industry after graduation.

So, if you are looking for a banking-related training course in Hong Kong that is designed to nurture talent at all levels, from beginners to senior executives and boost your career prospects, contact the Institute today and our friendly staff will be happy to answer any questions you may have.

Key features

The Certified Banker Programme is the flagship banking-oriented professional qualification programme of the HKIB and it is different from the other banking training course which are:

Recognised Professional Qualification / Designation

The Certified Banker Programme is the first ever professional bank training course in Hong Kong accredited by The Hong Kong Council for Accreditation of Academic and Vocational Qualifications (HKCAAVQ) at Level 6 under the Hong Kong Qualifications Framework (HKQF) – the same standard as a master’s degree.

This industry-recognised Professional Qualification meets all the regulatory requirements and is offered by Hong Kong’s premier banking training and certification institute – HKIB. HKIB was appointed by the Education Bureau (EDB) as a Professional Qualifications Assessment Agency (PQAA) in 2020 to offer quality-assured professional programmes and examinations.

The programme encompasses all relevant Units of Competency (UoCs) drawn from the Specification of Competency Standards (SCS) of the banking industry, and, as a vocational award, the programme combines academic knowledge with related work experience.

Professional Qualification can help you attain the specific skills you need to land your first job or progress further in your career. They are practical qualifications that relate to a specific job or career sector, and, unlike purely academic courses, they combine a mix of theory and practical learning and often include some work experience too.

Learners who have completed a particular level and acquired the relevant years of banking or finance related work experience will be entitled to use the respective CB Professional Qualifications.

After attaining the Certified Banker professional qualification, learners can apply the knowledge and skills they have gained directly to their job and employers can feel confident in their ability.

|

Programme

|

Award

|

Professional Qualifications

|

|

Certified Banker (CB Stage)

|

Postgraduate Diploma for Certified Banker

|

Certified Banker

HKQF Level 6

Registration no: 20/000543/L6

Registration Validity Period: 01 Aug 2020 – 31 Jul 2025

(with 3 years banking or finance related work experience)

|

|

Certified Banker (Stage II)

|

Professional Diploma for Certified Banker

|

Certified Banker (Stage II)

(with 2 years banking or finance related work experience)

|

|

Certified Banker (Stage I)

|

Advanced Diploma for Certified Banker

|

Certified Banker (Stage I)

(with 1 year banking or finance related work experience)

|

CB Affiliate:

Learners who have successfully completing a HKIB professional qualification programme (including training and examination requirements) but yet to fulfil the requirements on years of relevant work experience for certification will be automatically granted as CB Affiliate. Ordinary Membership with membership fee for the awarding year waived will also be granted to learners.

For details about CB Affiliate, please contact HKIB at (852) 2153 7800 or email at cs@hkib.org.

Honorary Certified Bankers

We understand that being recognised is as important as the programme itself. As such, selected bank CEOs have already been recognised as Honorary Certified Bankers and we hope to award more with the prestigious title which will not only help them build their professional network but also help to ensure future talent development for the industry.

Group photo of Honorary Certified Banker 2022

Group photo of Honorary Certified Banker 2023

Group photo of Honorary Certified Banker 2022

Group photo of Honorary Certified Banker 2023

Multi-Entry Point: reach talent outside the banking industry

Certified Banker is a bespoke banking oriented Professional Qualification programme designed for both existing bankers looking to advance their careers and also talent from outside the industry to gain the knowledge needed for their career switch. Whatever level learners are at in their career or discipline they are currently practicing, Certified Banker will ensure they gain the skills and experience most relevant to them to succeed in the world of banking. The entry requirements for the programme are broad and everyone from senior bankers to students are welcome to apply for the level most suited to them.

Ever- Enriching the syllabus to keep learners abreast with up-to-date knowledge

Certified Banker is a dynamic and constantly updated bank training programme to keep practitioners abreast on the rapid changes in the banking industry. It not only includes elements of the HKMA’s Enhanced Competency Framework (ECF), but also the latest industry developments, such as Greater Bay Area (GBA) banking knowledge, Environmental, Social and Governance (ESG), Technology and Data, as well as soft skills.

Certified Banker is a streamlined and well-recognized banking course offering a clear study path to achieve learners’ desired career development. Whatever level learners are currently at, Certified Banker is one of the most industry-recognized and accredited banking qualifications in Hong Kong that can help achieve their goals.

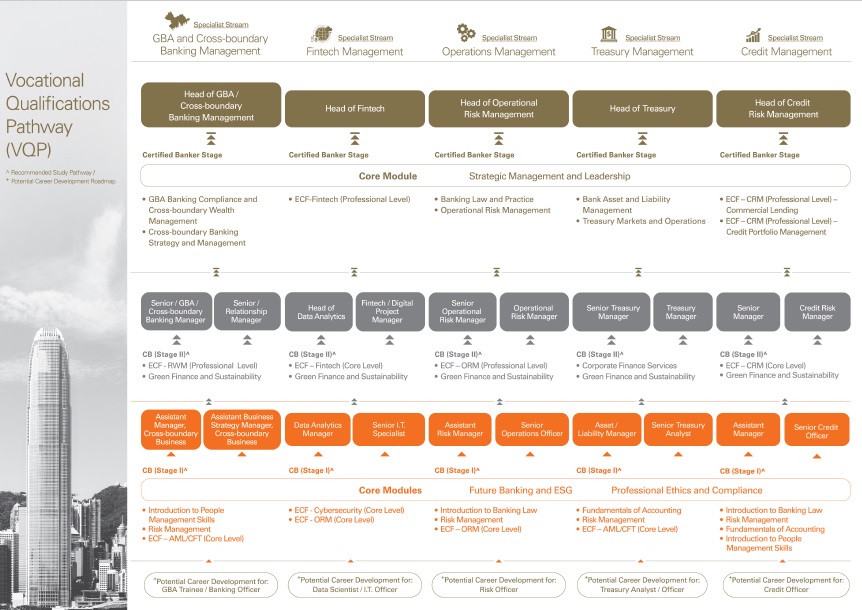

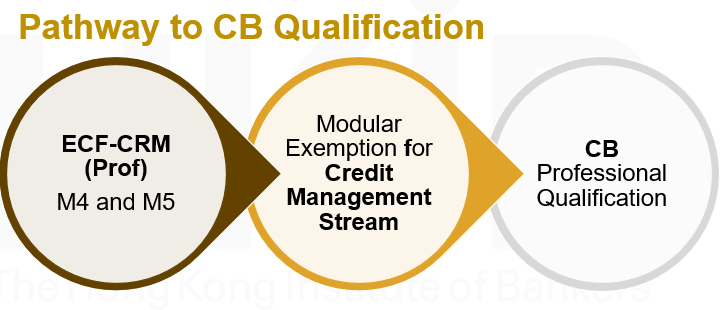

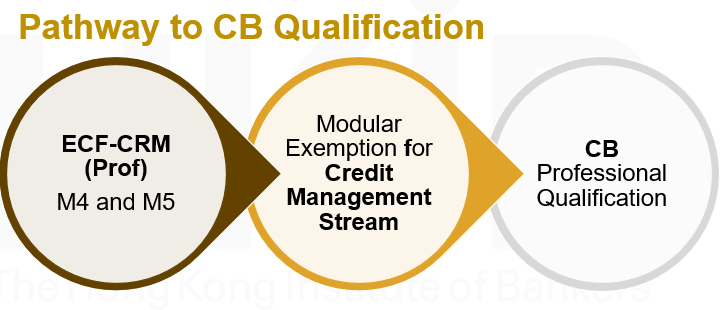

ECF integration

The Hong Kong Monetary Authority (HKMA) has been working together with The Hong Kong Institute of Bankers (HKIB) and the banking industry to develop an industry-wide competency framework – the Enhanced Competency Framework (ECF) for Banking Practitioners in Hong Kong. It establishes a set of common and transparent competency standards for different professional areas which are central to the ongoing development of the banking industry.For details, please refer to ECF overview.

To further increase the attractiveness and recognition of the Certified Banker (CB) Programme and setting this programme apart from others in Hong Kong, most ECF programmes have been integrated to make CB even more dynamic and comprehensive.

Practitioners with ECF qualifications can also shorten their learning journey via modular exemption and obtain another professional banking qualification to add to their resumes.

Network Expansion: CB Alumni and networking groups

The Certified Banker Programme is not only a banking programme, but also an opportunity for practitioners to further expand their professional network and for experienced bankers to help nurture junior banking talent. This talent-nurturing cycle, where Certified Bankers help other Certified Bankers, is beneficial for all learners to become more holistic and forward-looking.

To promote this idea further, CB Alumni will shortly be launched on top of various networking groups and reunions to gather all CB holders and learners together to form a strong bond.

Become holistic banking professional

The Certified Banker Programme aims to help practitioners become holistic banking professional.

The programme equips learners with general as well as specialist knowledge in areas most relevant to them. And on top of the programme itself, learners can continue learning through various channels (CPD, industry events, networking events etc.)

By embarking on a lifelong learning journey and expanding their professional network through this unique programme, practitioners can enjoy better career prospects and future-proof their talent.

Return to top

Programme structure

Find out more about the programme structure and start your study journey.

|

Postgraduate Diploma for

Certified Banker (CB Stage)

|

Complete the core module and obtain any one of the below specialist streams and attain a pass in the Final Case Study Assessment and Oral Assessment of the respective specialist stream

Core Module:

• Strategic Management and Leadership (Credit: 15)

Specialist Stream

1. Credit Management

• ECF – CRM (Professional Level) – Commercial Lending* (Credit: 30)

• ECF – CRM (Professional Level) – Credit Portfolio Management* (Credit: 30)

2. Treasury Management

• Bank Asset and Liability Management (Credit: 30)

• Treasury Markets and Operations (Credit: 30)

3. Operations Management

• Banking Law and Practice (Credit: 30)

• Operational Risk Management (Credit:30)

4. GBA and Cross-boundary Banking Management

• GBA Banking Compliance and Cross-boundary Wealth Management (Credit: 30)

• Cross-boundary Banking Strategy and Management (Credit:30)

5. Fintech Management

• ECF – Fintech (Professional Level)* (Credit: 60)

|

|

Professional Diploma for

Certified Banker (CB Stage II)

|

Obtain 60 credits of any TWO modules

• Green Finance and Sustainability (Credit:30)

• Corporate Finance Services (Credit:30)

• Finance of International Trade (Credit:30)

• Essential Fintech in Next-gen Banking (Credit:30)

• ECF – RWM (Professional Level)* (Credit: 30)

• ECF – AML/CFT (Professional Level)* (Credit:30)

• ECF – CRM (Core Level)* (Credit:30)

• ECF – ORM (Professional Level)* (Credit: 30)

• ECF – Fintech (Core Level)* (Credit: 30)

• ECF – Compliance (Professional Level)* (Credit: 30)

• ECF – GSF (Professional Level)* (Credit: 30)

|

|

Advanced Diploma for

Certified Banker (CB Stage I)

|

Obtain 20 credits from Core and 40 credits from Elective modules

• Fundamentals of Accounting (Credit:10)

• Introduction to Banking Law (Credit:10)

• Introduction to People Management Skills (Credit: 10)

• Risk Management (Credit:10)

• ECF – AML/CFT (Core Level)* (Credit:20)

• ECF – Cybersecurity (Core Level)* (Credit:20)

• ECF – ORM (Core Level)* (Credit: 20)

• ECF – Compliance (Core Level)* (Credit: 20)

• ECF – GSF (Core Level)* (Credit: 20)

• Qualification Certificate of Banking Professional (QCBP)* (Credit 10)

• ECF – Treasury Management* (Credit: 10) (Core Level)

|

|

Core Modules for all stages

|

• Future Banking and ESG (Credit:10)

• Professional Ethics and Compliance# (Credit:10)

|

*For exemption only

#no exemption is allowed

Award requirements

- Successfully attend and complete all modules

- Pass the examination including to obtain a pass in the Final Case Study Assessment and Oral Assessment for Certified Banker (CB Stage) stage; and

- Fulfill the credit requirements for the award.

Certification requirements

- Obtain the award; and

- With respective years of banking or finance related working experience for each stage

Assessment

CB (Stage I & II): All the modules are assessed by written examination.

CB Stage: All the modules are assessed by written examination. To attain the Postgraduate Diploma in a specialist stream, candidates are required to obtain a pass in the Final Case Study Assessment and Oral Assessment of the respective stream upon completion of TWO Postgraduate Diploma modules in the same stream.

Modes of study

Part-time

Return to top

Mode of instruction

FLEX Learning – Virtual Classroom / Face to face / Self-paced Learning

Entry requirement

Select the stage you would like to learn more:

Career advancement pathway

Find out your career advancement pathway.

For more details, please refer to CB flyer

Benefits for learners

1. Gain recognition with a professional banking qualification

2. Future-proof your talent with up-to-date knowledge

3. Advance your banking career

4. Get a head start when looking for a job in banking

5. Build your professional network

6. Enter into a lifelong learning journey

Alumni sharing

Check out what they learnt in Certified Banker:

|

Stories and Quotes

|

CB Alumni

|

|

Throughout the journey of my pursuance on Certified Banker professional qualification, I have opportunities to further enhance my knowledge and skillsets in various in-demand areas such as sustainable finance, fintech, banking in GBA. More importantly, the networking session offered by CB Alumni allowed me to meet with top bankers in the industry and learn from banking legends. All these initiatives align well with my bank, allowing me to further enhance my career.

|

HO Kwok Sze Calvin

->CB holder

->Vice President, Cluster Head

|

|

I am delighted to share with you all that I have obtained a new certification: Specialist Certificate in Green Finance and Sustainability from The Hong Kong Institute of Bankers!

This programme does not only provide me with a deeper understanding of Hong Kong’s green finance regulatory framework but enhances my professional knowledge in ESG and the financial development of Hong Kong. I learned relevant theories such as Green Finance, Green Bonds and Green Securitization which are essential for Next-gen banking.

In conclusion, this programme is an eye-opener for me as a law student without any business and finance background! I can’t wait to learn more about banking through Certified Banker Programme!

|

FONG Heng Andre

->Year 2 Law student from City University of Hong Kong

->Certificate Holder of Specialist Certificate in Green Finance and Sustainability

|

Scholarship

Each year, HKIB selects the top two candidates from each module in Certified Banker Programme and award them with the scholarship as recognition. This is the way for HKIB to promote academic excellence and motivate future students to push themselves to achieve same high level of performance.

The two top candidates in Certified Banker Programme, provided that all other granting requirements are met, can be awarded with a cash incentive (HKD4,000 for CB (Stage I); HKD5,000 for CB (Stage II); HKD6,000 for CB Stage), and a study coupon which can provide candidates to study one more professional qualification offered by HKIB with all training and examination fees waived.

FAQ

1) Which stage should I enrol in?

CB allows different learners to start their learning journey at different stages. For details of the eligibility, please refer to the "entry requirements"

2) Can I apply for modular exemption?

Yes, if you have already completed similar training, you may apply for modular exemption, please refer to the “sample modular exemption form” in the download area.

3) Can I enrol in various modules at a time?

You can enrol multiple modules within a stage. However, you may also need to be aware of the expected self study hours as you have to be prepared for the examination as well but not just the training sessions.

Return to top

Group photo of Honorary Certified Banker 2022

Group photo of Honorary Certified Banker 2022